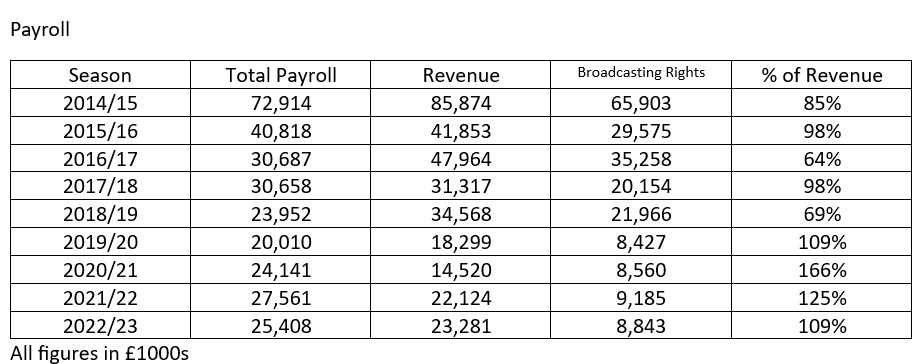

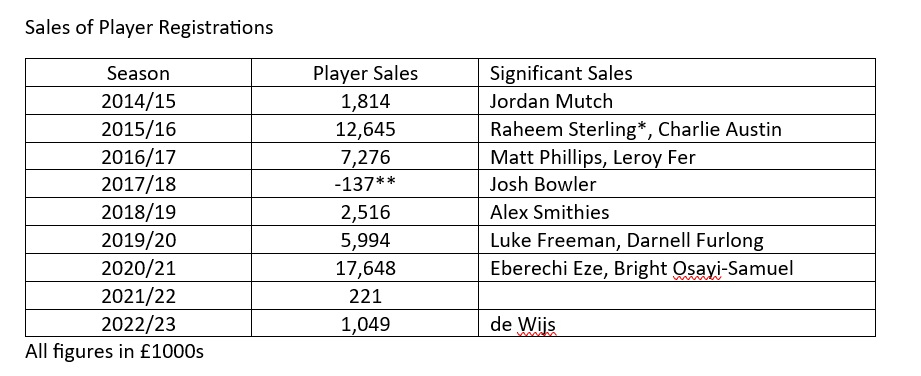

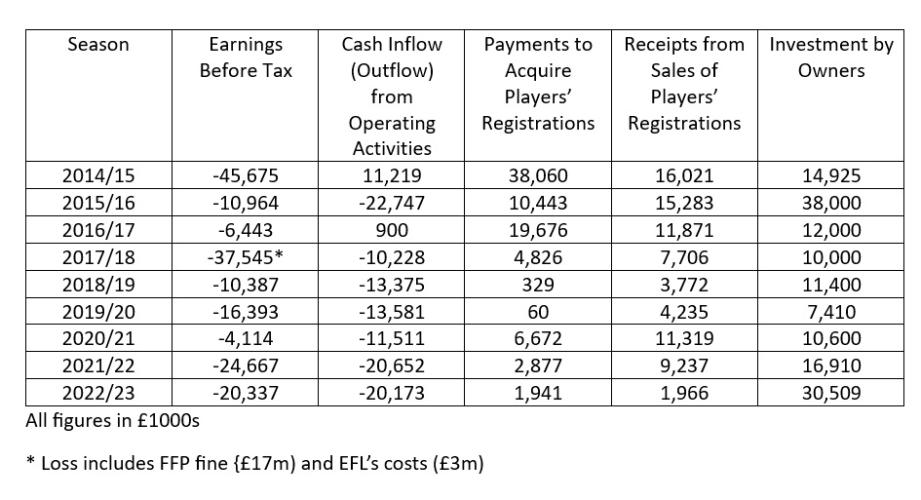

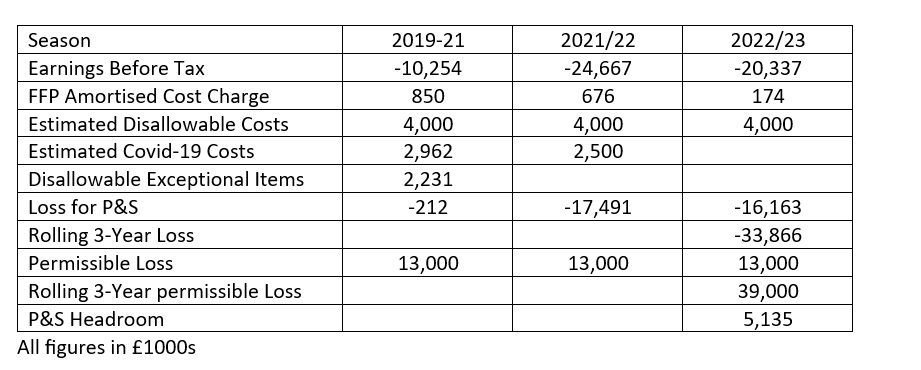

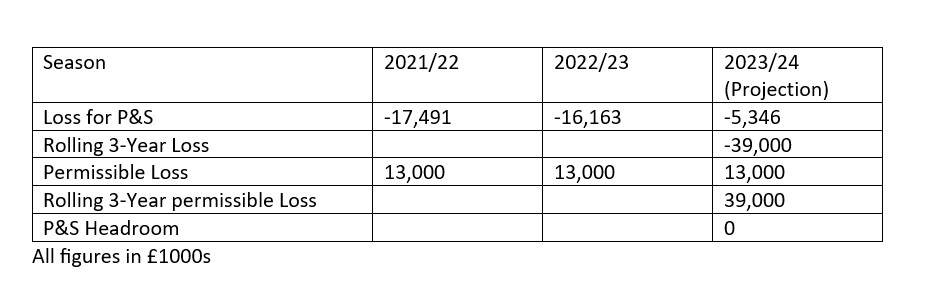

Always crashing in the same car – Column Wednesday, 21st Feb 2024 15:48 by Simon Dorset Our resident financial columnist Simon Dorset is back for his annual analysis of QPR’s accounts, which they season show an FFP-pushing loss of £20m+ and cover the disastrous 2022/23 season which began with Mick Beale in charge. In his first interview as Queens Park Rangers’ new CEO, Christian Nourry’s confirmation that the club was not in a position to spend any money in the January transfer window did not come as any surprise. This is as a direct result of the position decisions made by the owners in the previous two seasons have left the club with regard to FFP headroom. Seduced by the glint of promotion shimmering tantalisingly on the horizon, their decision to offer expensive full-time contracts to the players who had made an important impact on the club during loan spells was then compounded the following season by acquiescing to Michael Beale’s condition that he would only become the club’s new manager if the likes of Ilias Chair, Chris Willock and Seny Deing were not sold that summer. Both decisions completely disregarded the philosophy put in place by Les Ferdinand and Lee Hoos who, I can guarantee, would have painstakingly ensured that the consequences of failure would have been completely understood by them. The subsequential flurry of loan deals and signings at the end of last month does not alter the fact that we are now living with those consequences and the accounts for the 2022/23 season starkly illustrate the invidious position this has left the club in with the two elements most affected by those decisions being prime examples: payroll and sales of player registrations.  This table clearly shows the wage bill being repeatedly slashed following the club’s relegation from the Premier League at the end of the 2014/15 season in line with the reduction of revenue mainly due to falling broadcasting rights (which include parachute payments). The loan signings of Austin, Johansen etc. in January 2021 significantly reversed this trend and the impact that their permanent signings in the close season the following summer made was enormous. Thankfully the latest set of accounts, released this week, show the total payroll started to come down in the 2022/23 season, but the likes of Leon Balogun and Jake Clarke-Salter along with the loan deals for Ethan Laird, Tim Iroegbunam, Jamal Lowe and Tyler Roberts ensured that it remained far too high for a club with our revenue.  * The Sterling “sale” refers to QPR’s sell-on clause activated by his transfer from Liverpool to Manchester City. The club’s stated policy of developing players and selling them for a profit started to make an important contribution to the club’s revenue in the 2018/19 season and, while not every season can be expected to be as fruitful as 2020/21, completely abandoning it, particularly on the back of an unrewarding season, left a gaping hole in the club’s precarious finances. The headline figures from QPR’s 2022/23 accounts have already been thoroughly dissected elsewhere… Message board threads here, and here or Niall Rogers’ annual Twitter thread here. Rather than retread that ground, I’m going to highlight some cash flow items instead. Whereas the club’s profit and loss statement is subject to accounting jiggery-pokery and can, within legal limits, be manipulated by interpretation, cash flow is fact. As its name suggests, it is simply tracking the money coming in to and going out of the club. As a general rule, a business can sustain losses as long as the cash flow remains good. Before getting to the table, it is probably important to clarify what is meant by the heading at the top of the third column - Cash Inflow (Outflow) from Operating Activities. Included in a club’s profit (loss) are a number of transaction where no money either goes into or out of the club’s bank account. Typical examples of this would include depreciation of any tangible assets such as their stadium, amortisation of the purchase cost of the players (intangible assets) and any impairment of their remaining net book value. Impairment is reducing the book value of a player over and above the annual amortisation. When QPR were relegated at the end of the 2014/15 season they applied an impairment charge of slightly over £11.5m which had the effect of pulling the cost into a season where there was some FFP headroom while lessoning the burden of amortisation on later seasons. A further difference between the Cash Inflow (Outflow) from Operating Activities and the club’s profit (loss) are transactions which enjoy extended credit terms. Eberechi Eze’s transfer to Crystal Palace is a prime example of this. The whole of the profit (excluding add-ons) will have been accounted for in the 20/21 accounts, but only half of the money was received in that period, with Palace paying the second tranche the following season.  The huge increase of investment by the owners for the 2022/23 season includes a significant investment in the club’s new training facility at Heston as well as the effect of far lower receipts from the sales of players’ registrations. There are many other factors which would need to be included to show the complete picture, such as expenditure on the new training facility, but hopefully this table gives a flavour of the relationship between player trading and the investment required by the shareholders to cover the club’s losses. The all-important question is where do these accounts leave the club with regards to FFP. As a probably unnecessary reminder, Championships clubs are permitted losses of up to £39m over a rolling three-period. In addition to infrastructure projects, any transactions related to our historic FFP fine and any Covid-19 related costs, expenditure such as infrastructure projects, youth development, community schemes and women’s football are excluded from the FFP calculation. I will continue to use Swiss Ramble’s estimate of £4m for QPR for this. The following table shows where I believe we are.  A couple of brief notes before continuing. For full details of why the 2019/20 and 2020/21 seasons are shown as one and how I’ve calculated their Covid costs, please see my year before last’s article Paying Dividends. In an attempt to understate Covid-19 allowances, in last year’s article On the Edge of the Precipice I chose not to include the £2.5m permitted by the FFP regulations for the 2021/22 season, however it is inconceivable that the club didn’t claim it, so I think it is beneficial to do so now. The FFP amortised cost charge is down to the accounting conventions surrounding our FFP fine. I think it will be an unnecessary distraction for me to try to explain how that works. These figures show that QPR had around £5m headroom within their FFP calculation at the end of the 2022/23 season. While this may seem relatively comfortable, it is a big drop form the £15.9m (restated after including the £2.5m Covid-19 allowance) headroom from the end of the previous season. If we then roll these figures forward for another season (2023/24) the picture gets even more bleak. The combined 2019/20 and 20/21 seasons, which include the sale of Eze, get replaced by a season with no major sale and no Covid-19 allowances.  QPR’s loss has to decrease by £10.8m to avoid breaching FFP. This does assume that the £4m disallowable costs is accurate and that there aren’t any other factors that I’ve missed. Only the club and the EFL will know for certain, but it does broadly agree with the predicament ill-advisedly described by Beale in a supporters’ meeting at the beginning of last season. It is hard to see how this reduction has been made. The sale of Seny Dieng to Middlesborough and of Rob Dickie to Bristol City over the summer was an important step, but the club is a heavily reliant on reducing the payroll to achieve it. Among others, presumed high earners such as Leon Balogun, Luke Amos and Chris Martin were released at the end of their contracts, while loanees Ethan Laird, Tim Iroegbunam, Jamal Lowe and Tyler Roberts all returned to their parent clubs. This season is the first that QPR have started without a single player on loan for many years. Stefan Johansen left by mutual consent which would have made a partial saving on his wages, but the majority of these players were replaced, albeit with players on lower wages. The accounts state that the net impact of post year end player trading is £1.775m inflow. The word inflow suggests to me that this is a cash figure rather than profit. Both Dickie and Johansen would have had a residue net book value, the unamortised portion of their transfer costs, which needs to be taken into consideration. The club finally awoke to the revenue that can be made by selling naming rights. The MATRADE Loftus Road Stadium was swiftly followed by the Achilleus Security Stand, The Bhatia Stand and the TSG Elite Training & Performance Centre. Other noteworthy savings include both Les Ferdinand and Chris Ramsey leaving their roles at the club and a contract extension for Lyndon Dykes which will have spread the annual amortisation of his residue net book value over a longer period.

On the face of it, that doesn’t look like a big enough reduction in cost. However, the fact that, on the strength of loaning out Andre Dozzell, Charlie Kelman and Stephen Duke-McKenna, the club felt able to sign Lucas Andersen and Michael Frey as well as taking Isaac Hayden and Joe Hodge (reportedly on remarkably good terms) on loan would suggest otherwise. It does make you wonder how much money we were paying some of the now departed players. Football League clubs have to submit their Future Financial Information to the EFL by March 1st. This is projected accounts for the current season. I would suspect that QPR will be high on their list to scrutinise and would expect any bad news would be leak out relatively quickly. The longer we hear nothing, the more comfortable I will feel. I’ve read a few comments about the owners showing a lack of ambition, but nothing could be further from the truth; it is their over ambition that has put the club in this position. I have every sympathy with, and would fully support, a business model of financially positioning the club for a promotion push every three years to dovetail with FFP reporting periods, but to do so on two consecutive season was reckless. Combining this with a policy of allowing the manager to dictate transfer policy over the man charged with giving the club a long-term strategy, has left us with no discernible direction, an unbalanced squad and staring relegation in the face.

I know that some see relegation as an opportunity to rebuild without being encumbered by the Championship’s FFP regulations due to different criteria being employed by the EFL at that level. While this is true all the time a club stays out of the Championship, on promotion back to it the club returns to being assessed on a three-year rolling period which will include any seasons out of the Championship. The regulations make no exceptions for clubs promoted from League One, the loss thresholds relate to members of “The League” not specifically the Championship. There is no carte blanche to throw pots of money at our problems before returning stronger than before and nor should there be. It could be argued that the cost of running a dilapidated, old stadium in London, the lack of any non-match day revenue and struggling to attract the local young talent to the club due to the more attractive alternatives on our doorstep made this position inevitable, but other clubs cope with similar. As grateful as I am to the owners for their incredible benevolence, unless they address their failings, contain their ambition and adhere to a properly costed business plan, I fear we are going to continue to be, as Bowie once put it, always crashing in the same car. Also by this author >>> Edge of the precipice – Column >>> Paying Dividends >>> Grounds for Concern >>> Gordon Jago: Leading From The Front >>> The Trust >>> Accounting for success >>> Gambling with FFP >>> The greater evil >>> Terry Venables: My first hero >>> QPR’s fairytale of New York If you enjoy LoftforWords, please consider supporting the site through a subscription to our Patreon or tip us via our PayPal account loftforwords@yahoo.co.uk. Pictures — Action Images The Twitter @loftforwords Ian Randall Photography Please report offensive, libellous or inappropriate posts by using the links provided.

You need to login in order to post your comments |

Blogs 31 bloggersCharlton Athletic Polls |